Workers’ Compensation Insurance

Protecting Your Clients with Comprehensive Workers' Compensation Coverage

Covering medical costs and lost wages for workers who become injured or ill while on the job

From slips, trips and falls to working with power tools and operating heavy equipment, the construction industry has a high incidence of work-related on-the-job injuries – which can result in an increase of workers’ compensation claims. How can your clients provide their employees with medical care and compensation for lost wages in the event of a work-related accident or illness?

Workers’ compensation insurance provides medical expenses and partial missed wages when an employee is injured on the job or develops an occupational illness. Workers’ compensation benefits also cover temporary or permanent disability and death benefits.

Because every state has its own workers’ compensation laws, businesses should know the requirements for their individual state.

Safeguarding Businesses with Comprehensive Workers' Compensation Coverage

Covering medical costs and lost wages for workers who become injured or ill while on the job

From slips, trips and falls to working with power tools and operating heavy equipment, the construction

industry has a high incidence of work-related on-the-job injuries – which can result in an increase of workers’ compensation claims. How can your clients provide their employees with medical care and compensation for lost wages in the event of a work-related accident or illness?

Workers’ compensation insurance provides medical expenses and partial missed wages when an employee is injured on the job or develops an occupational illness. Workers’ compensation benefits also cover temporary or permanent disability and death benefits.

Because every state has its own workers’ compensation laws, businesses should know the requirements for their individual state.

Workers' Compensation Insurance

policy coverage

Examples of when a workers' compensation insurance policy would provide coverage:

Partial lost wages for an employee or contractor during the time they are unable to perform regular duties.

Medical care, including ambulance and emergency room expenses.

Ongoing medical care, including physical therapy and rehabilitation services.

Death benefits paid to dependents in the event of an employee’s death due to a work-related injury or illness.

Workers' Compensation Insurance

market

At BTIS, we understand some states may impose stricter requirements for some businesses that may pose an increased risk of injury, such as roofers or projects that require working outside in states where extreme weather conditions are common. It’s why we offer a wide range of A+ rated workers’ compensation carriers to meet the needs of a variety of construction-related businesses.

Customer service is always right, and very informative.

~ Yolanda

I always have great Customer Service Experience.~ Monteiro

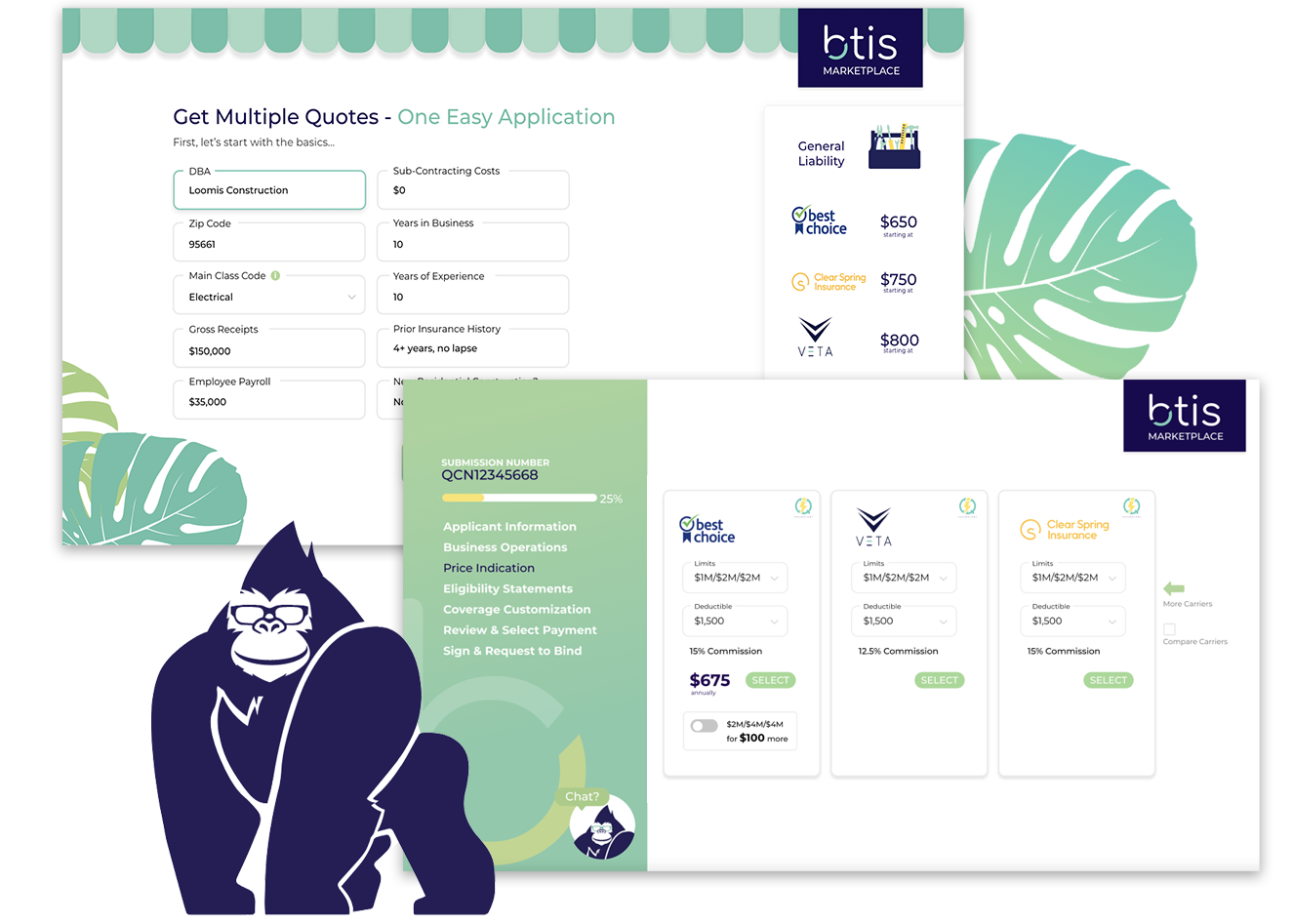

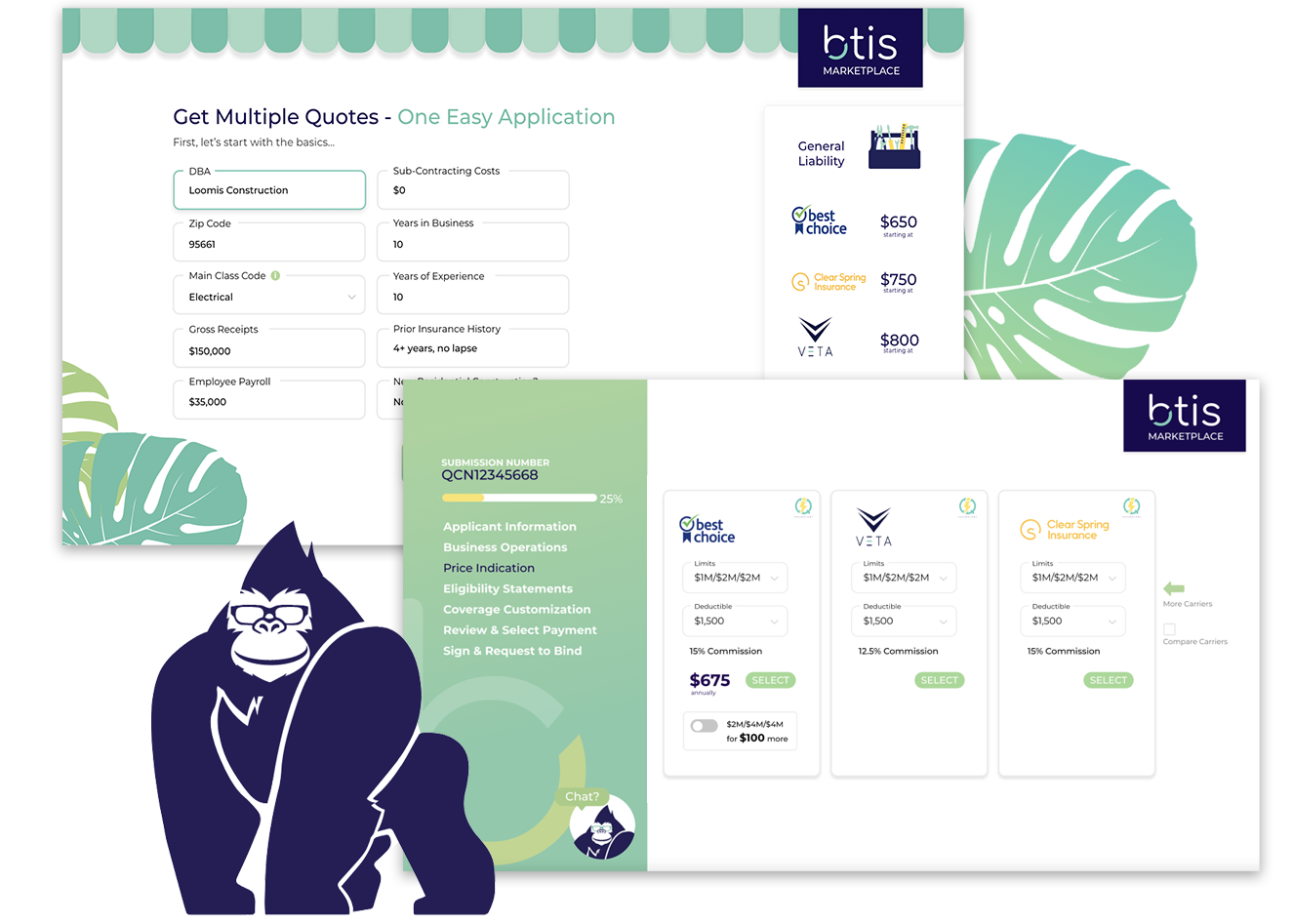

Quick service & automated quoting system. ~ John

Quick to answer questions and easy to bind. ~ Kristy

Ya’ll ROCK! ~ Scott

Simple, quick and inexpensive~ Brenda

Customer service is always right, and very informative.

~ Yolanda

I always have great Customer Service Experience.~ Monteiro

Quick service & automated quoting system. ~ John

Quick to answer questions and easy to bind. ~ Kristy

Ya’ll ROCK! ~ Scott

Simple, quick and inexpensive~ Brenda

Workers' Compensation Insurance

market

At BTIS, we understand some states may impose stricter requirements for some construction-related businesses that may pose an increased risk of injury, such as roofers or projects that require working outside in states where extreme weather conditions are common. It’s why we offer a wide range of A+ rated workers’ compensation carriers to meet the needs of a variety of construction-related businesses.

Workers' Compensation Insurance

faq

Did you know...

Cross-selling increases client retention

Increased Customer Retention: Strengthen client loyalty with complementary coverage.

Higher Customer Value: Clients purchasing multiple policies increase their long-term value.

Better Risk Management: Identify coverage gaps and provide suitable policies for effective risk protection.

Increased Revenue: Generate more sales and income from existing clients.

Improved Customer Experience: Simplify the insurance process by consolidating policies in one marketplace.

Enhanced Upselling Opportunities: Increase revenue by offering higher-value coverage options to clients.

Strengthened Referral Network: Expand your customer base through referrals from satisfied clients.

Not yet Registered?

Please register here to become a BTIS producer.

Already Registered?

Please login here.