Transportation Insurance

Tailored Insurance Solutions for Contractors

Protection for the unique risks contractors and construction businesses face

Homebuilders. Developers. Artisan Contractors. Masons. Every day, construction operations of all types face unexpected risks unique to their business. How can your clients protect against these risks that are normal to day to day business processes?

Even the most careful businesses can face unexpected incidents. A commercial general liability insurance policy protects against claims – on and off the jobsite – that could put a business at financial risk.

Tailored Insurance Solutions for Contractors

Protection for the unique risks contractors and construction businesses face

Homebuilders. Developers. Artisan Contractors. Masons. Every day, construction operations of all types face unexpected risks unique to their business. How can your clients protect against these risks that are normal to day to day business processes?

Even the most careful businesses can face unexpected incidents. A commercial general liability insurance policy protects against claims – on and off the jobsite – that could put a business at financial risk.

General Liability Insurance

policy coverage

Examples of when a general liability insurance policy would provide coverage:

While visiting the company’s business office to discuss plans for a project, a client slips, falls and becomes injured – and now requires medical care.

During a home remodel, a client’s personal property becomes damaged by the construction crew’s equipment.

A competitor files a lawsuit, alleging that the company has spread slanderous remarks about the other business’ quality of work and sues for damages.

General Liability Insurance

market

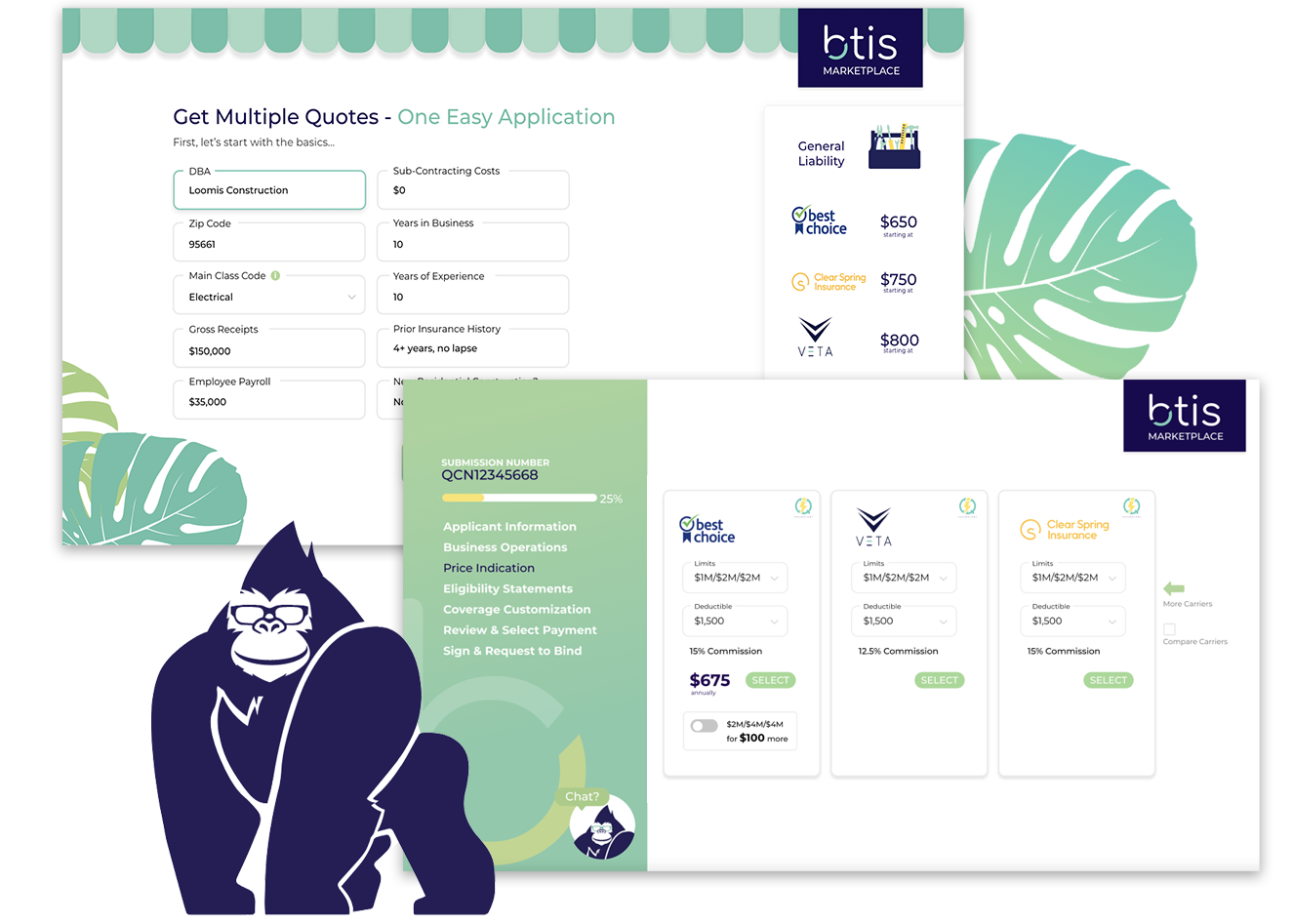

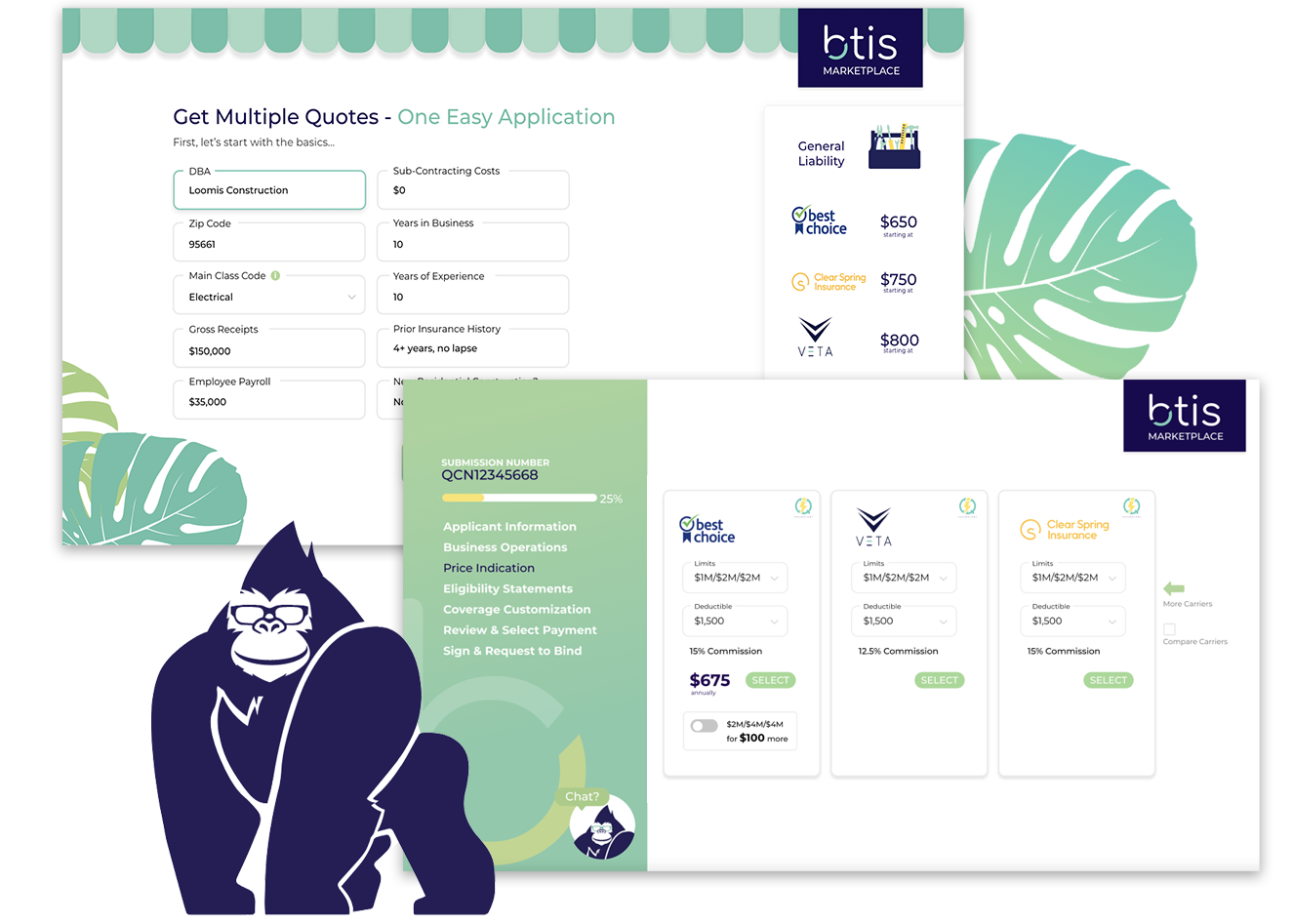

It can be a challenge to find general liability insurance that meets the specific needs of various types of commercial contractor business operations.

At BTIS, we have access to a wide range of A+ rated carriers, offering comprehensive general liability insurance coverage to best fit the needs of your clients.

Our markets offer commercial general liability insurance that protects your clients from:

Third-party bodily injury and property damage

Personal injury and advertising injury liability

Products and completed operations

Medical payments to others

Great responsive customer service, competitive pricing, easy renewals, what's not to like? I have referred several agents to BTIS.

~ Debra

I love the rater, and that you can get quotes so quickly. ~ Eileen

Multiple carriers and online approval. ~ Paolo

It got me closer to retirement. ~ Ric

Great service and carrier selection. ~ Ken

How easy it is to get everything done and the email reminder of policies expired. ~ Candra

Friendliness and efficiency. ~ Alee

Great responsive customer service, competitive pricing, easy renewals, what's not to like? I have referred several agents to BTIS.

~ Debra

I love the rater, and that you can get quotes so quickly. ~ Eileen

Multiple carriers and online approval. ~ Paolo

It got me closer to retirement. ~ Ric

Great service and carrier selection. ~ Ken

How easy it is to get everything done and the email reminder of policies expired. ~ Candra

Friendliness and efficiency. ~ Alee

General Liability Insurance

market

It can be a challenge to find general liability insurance that meets the specific needs of various types of commercial contractor business operations.

At BTIS, we have access to a wide range of A+ rated carriers, offering comprehensive general liability insurance coverage to best fit the needs of your clients.

Our markets offer commercial general liability insurance that protects your clients from:

Third-party bodily injury and property damage

Personal injury and advertising injury liability

Products and completed operations

Medical payments to others

General Liability Insurance

faq

Did you know...

Cross-selling increases client retention

Increased Customer Retention: Strengthen client loyalty with complementary coverage.

Higher Customer Value: Clients purchasing multiple policies increase their long-term value.

Better Risk Management: Identify coverage gaps and provide suitable policies for effective risk protection.

Increased Revenue: Generate more sales and income from existing clients.

Improved Customer Experience: Simplify the insurance process by consolidating policies in one marketplace.

Enhanced Upselling Opportunities: Increase revenue by offering higher-value coverage options to clients.

Strengthened Referral Network: Expand your customer base through referrals from satisfied clients.